What’s Value-Based Healthcare?

Healthcare providers pursue and strive to balance every dimension of the triple objective of achieving better clinical results and better patient satisfaction while having the lowest costs possible. Different providers in different regions address these constraints with certain variations, but the permanent tension between these three variables remains unchanged.

There’s been a transformation over the years in how the different healthcare agents interact with each other and the incentives that are given across the healthcare value stream. This transformation has been at its peak, with the increased offer of innovation, globalization, the development of specific regulations and industry standards, more scrutiny, and competition fueling this change.

Healthcare providers have been turning the archaic “Profit-Based Healthcare” into “Value-Based Healthcare” (VBHC). VBHC puts the focus on patients, as the entire health ecosystem is built around them. This forces the whole value stream to reorganize itself and differentiate itself to survive. In simple and holistic terms, the goal is to maximize the key performance indicators (KPI) related to patient outcomes, in relation to the costs needed to achieve those results. This dynamic equilibrium allows us to understand that high costs are not to be avoided but are justified if they yield significantly better outcomes for patients.

A VBHC approach conjugates the often irreconcilable needs of the three main healthcare agents: patients (who demand better outcomes and experiences at smaller costs and with less invasiveness), providers (greater efficiency and patient satisfaction, at affordable and cost-effective investments), and payers (control costs, diversify the portfolio and reduce risks)1.

Robotics in Healthcare: the breakthroughs

The idea of robotic surgery was initially developed for the military to enable surgeons to operate on wounded soldiers from a remote and safe location.

They first entered the civilian operating room in 1999, for urology, gynecology, and bariatric surgeries, and the first years have been focused on establishing the validity of robotics and the first steps of market introduction through early-adopting institutions.

Upon the establishment and acceptance of robotics, surgeons, and hospitals needed to redesign their ORs and ways of working to get the best out of robotics, instead of just replacing minimally invasive or open-surgical techniques with robots. As efficiencies come into action and technology itself evolves, robotic design, specificities, and use for cardiothoracic, general, head and neck, orthopedic and spine, neurological, and pediatric surgery are now a reality3.

Robotics in Healthcare: the barriers

Despite having an increasing market value and attractiveness, being one of the key trends in healthcare for the coming years, and the subject of significantly large investments (both with respect to R&D and M&A events), robotics and their benefits are only provided in a few selected indications in a limited number of fields of application.

Twenty years into the development of the robotic surgery market, approximately 10% of procedures in the USA are being done robotically, and globally that number drops to 2%2,3. Until the adoption rates of robotics are high across all fields and geographies and its benefits are established, the VBHC principles are not met. This raises the question: What are the main barriers to establishing Value-Based Robotics as a reality?

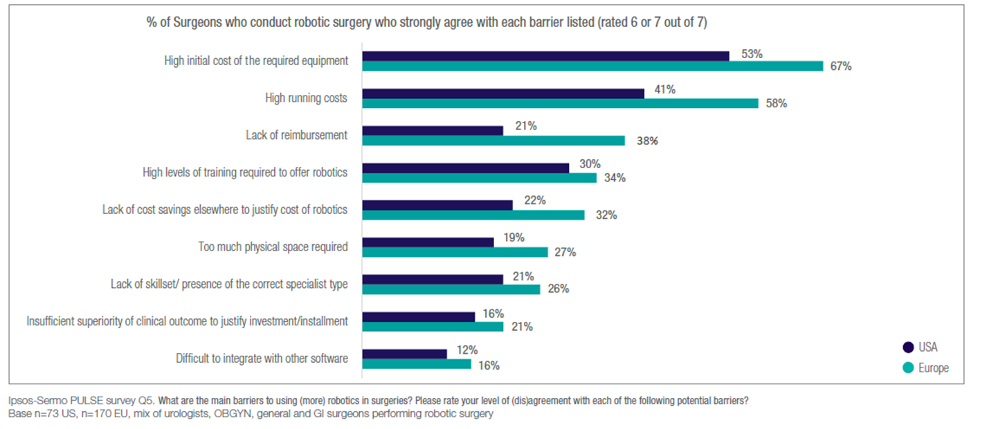

A major study developed by Ipsos has tried to list what are the barriers to increasing the use of robotics in surgeries. The results have ranked the biggest hurdles are associated with practicality and cost. The key five aspects in consideration are4:

• Too much physical space is required: the currently available robots-on-wheels solutions, often employing modified anthropomorphic arms that are commonly used in industry, end up having a size and weight which contrasts with the need for minimal invasiveness. Hospitals are required to perform modifications to their infrastructure and the ORs, as well as change clinical workflows, as the surgeon’s access to the surgical field is physically restricted.

• High initial and running costs of the required equipment: the equipment costs, running costs (disposables costing thousands of euros per procedure), and infrastructure and resource costs (specialized operating rooms, trained and experienced staff, and special non-standard procedures) are often prohibitively high. This means that robots tend to be focused on centers of excellence or university hospitals with the financial capacity to fund the investment.

• High levels of training required: hospitals are often required to invest significant sums to train their staff for weeks to have an accredited center, as well as paying monthly fees to manufacturers to have clinical support specialists attending surgeries to technically support the procedure. This creates a high dependency, both from the robotic companies and from the internally trained staff.

• Lack of adequate government reimbursement: due in part to the lack of convincing clinical evidence (see next point), this limits the uptake of robotic solutions. The limited out-of-pocket affordability means that suitable patients or payers choose more affordable, reimbursed methods. In the US and South Korea, robotics is covered by private insurers under “minimally invasive” codes, but it increases the insurance premiums for everyone. Where reimbursement exists, the challenge is that the healthcare reimbursement system is outdated, as it has not caught up with improvements in patient recovery (patients are forced to stay in the hospital for several days to be reimbursed, despite robotics already being used in surgeries in ambulatory and outpatient settings) and coding has not caught up with the new robotic indications (some procedures that are more often performed now because of robotics do not have a code, or the reimbursement does not match the value given by robotics). Finally, most of the existing robots are released only for specific indications and, even if the technology can be adapted to support more than one application, in more than one medical specialty, they cannot be used because of these regulatory constraints.

• Insufficient evidence on clinical benefits to justify investment: for most of the indications, there is not enough clinical evidence of significantly superior outcomes, compared to conventional methods, to justify the vastly increased costs (twice as expensive, or more, per procedure). The published literature gives mixed evidence, either establishing a significant equivalence in terms of outcomes, or showing improvements in some specific outcomes when compared to standard surgical methods. There is even evidence of poorer clinical outcomes in cancer operations where the surgeons are not fully qualified to perform the procedures. This forces most of the decision-makers to look for cost-offsetting arguments to justify the investment in robotics, facing again challenges with the high initial and running costs.

Interventional Systems, Micromate™, and how we’re unlocking Value-Based Robotics

Interventional Systems is the precision medical robotics company for the 21st century. Over the past years, we have been bringing together technology and medicine to build cutting-edge, miniature robotic solutions that make for more precise, seamless, and cost-effective image-guided medical interventions.

It is our goal to democratize robotics by improving the outcome of medical treatments and life quality by making image-guided robotic interventions the standard of care, and not the exception.

In this series of blog posts, we address how exactly we manage to overcome every single one of the obstacles mentioned above. Keep reading and check the subsequent episodes of the Value-Based Robotics saga!